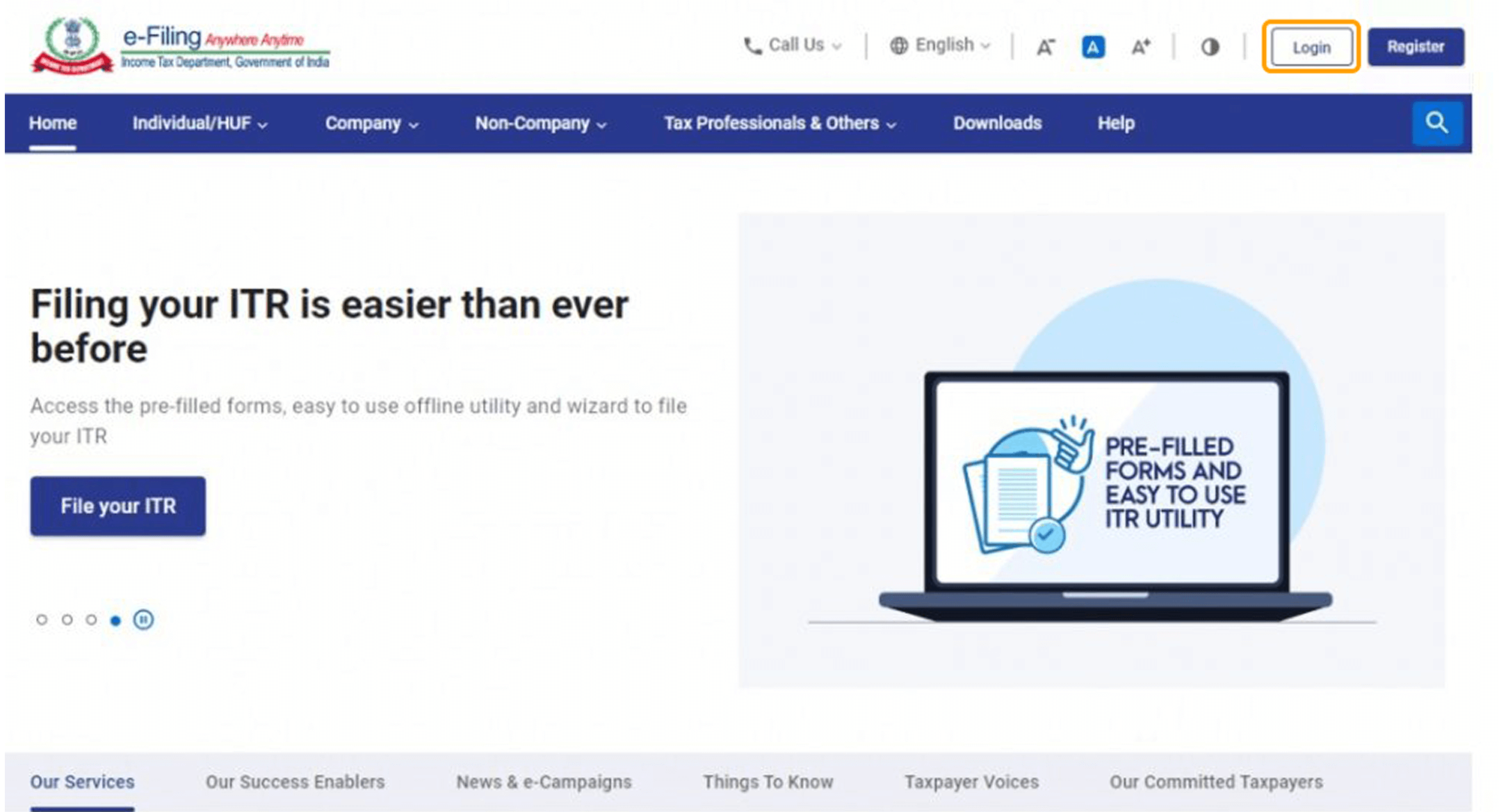

STEP 1 - Visit the Income Tax website and login using the following link:https://www.incometax.gov.in/iec/foportal/

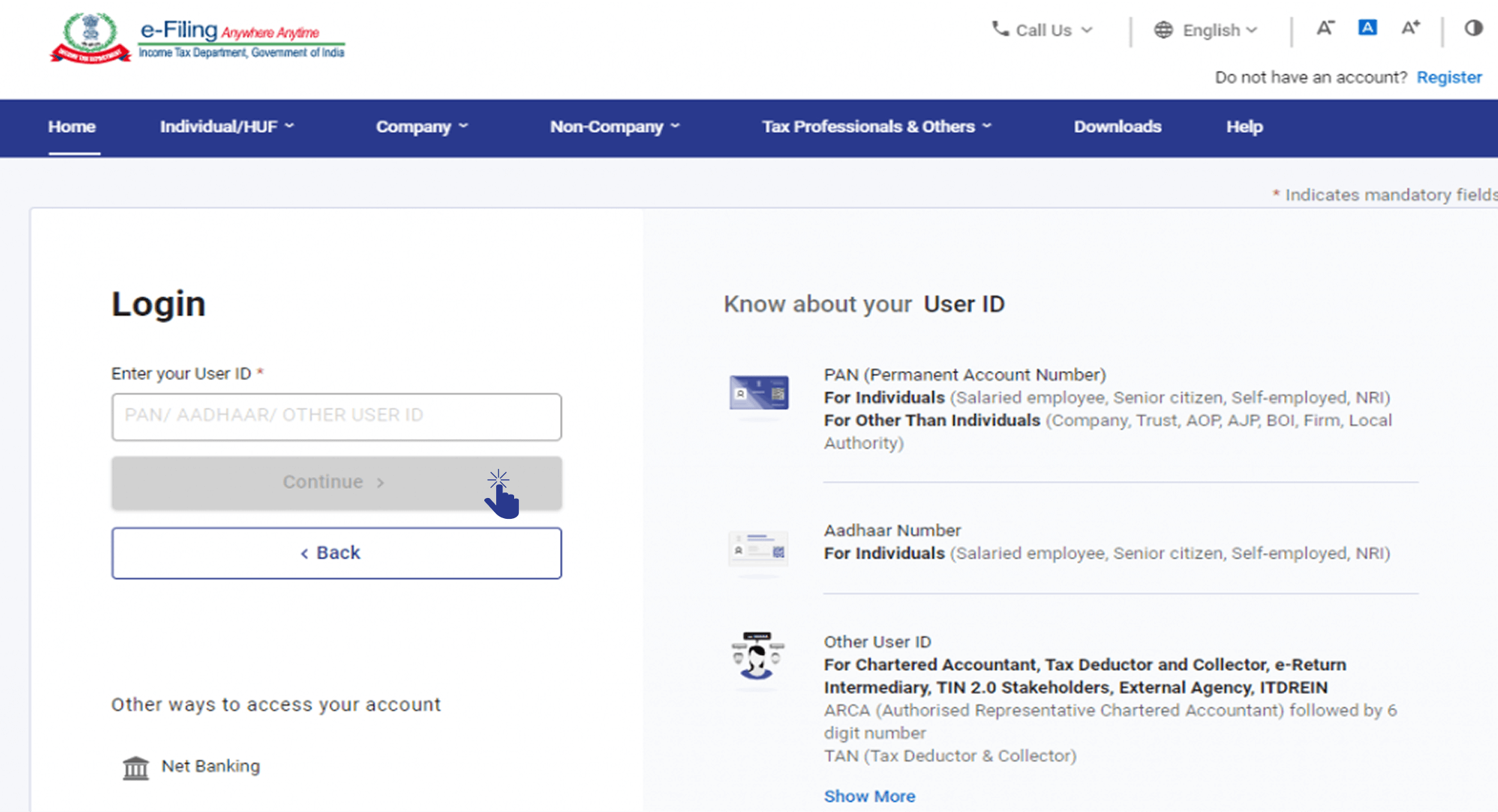

STEP 2 - Enter your user ID - It can be either PAN or Aadhaar number. If the user ID is invalid, an error message will be displayed. Continue with valid user ID details.

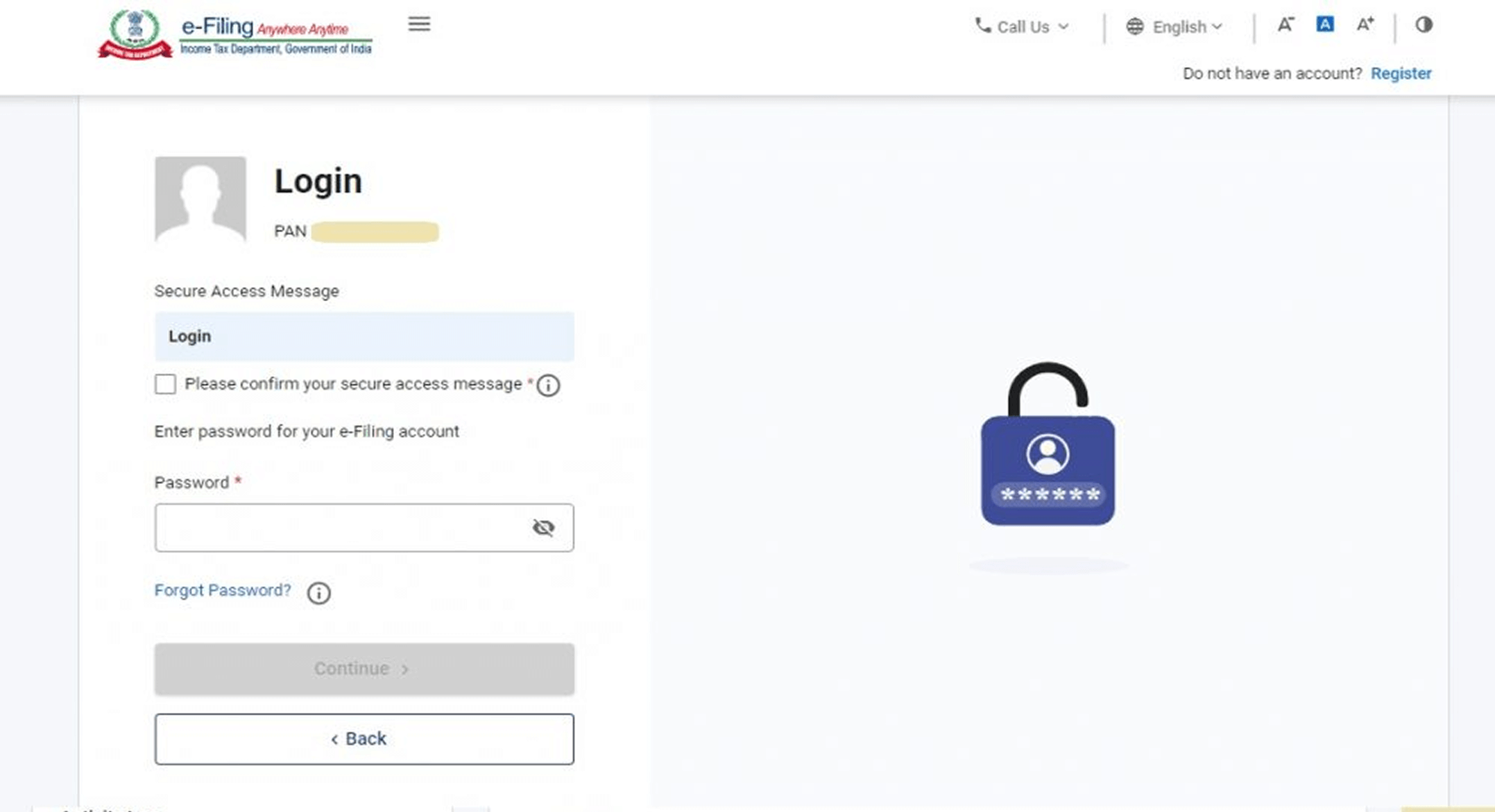

STEP 3 - Enter the password and continue.

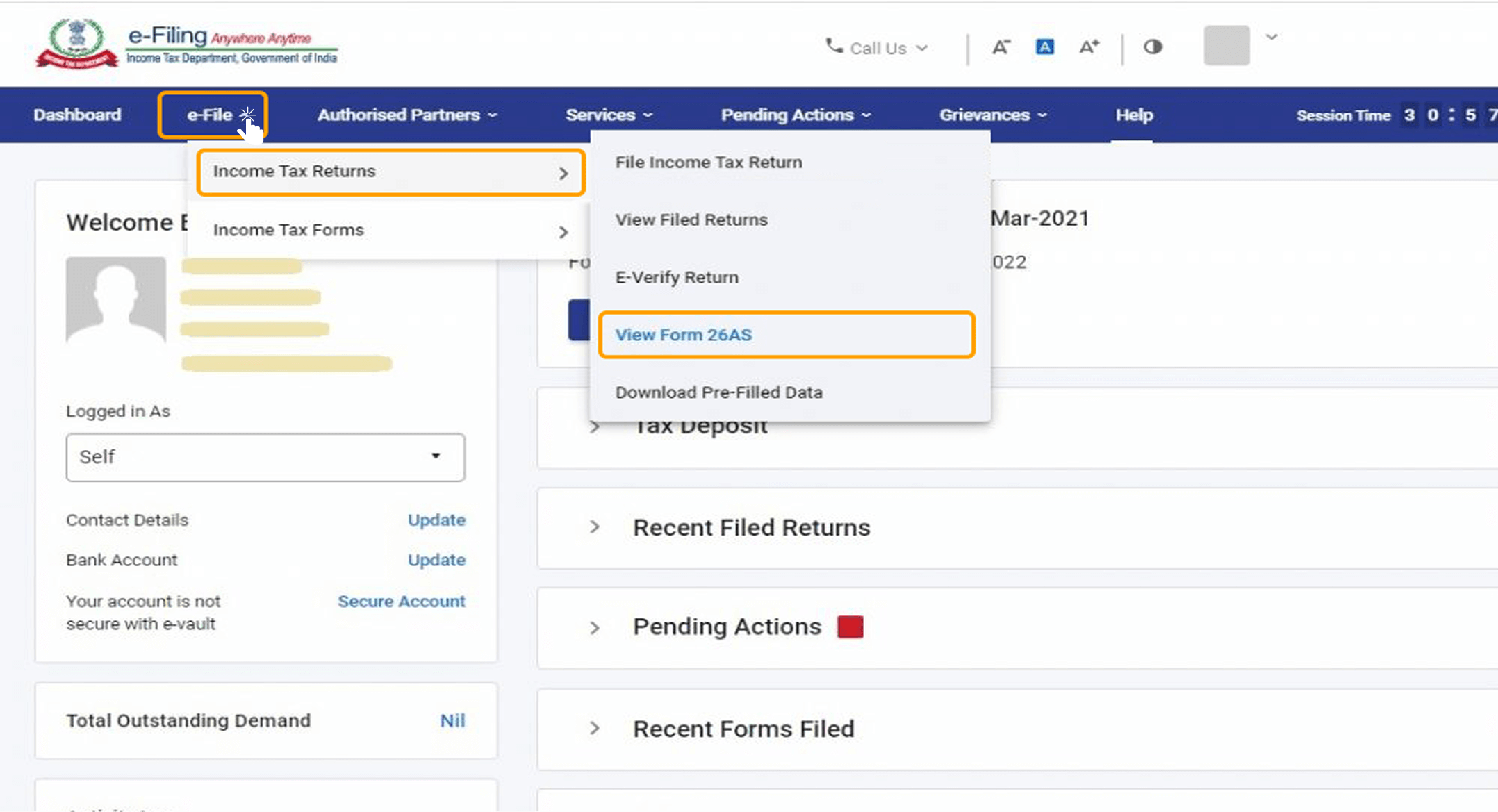

STEP 4 - Go to 'e-file'. Click on 'Income Tax Returns' and select 'View Form 26AS' in the drop-down.

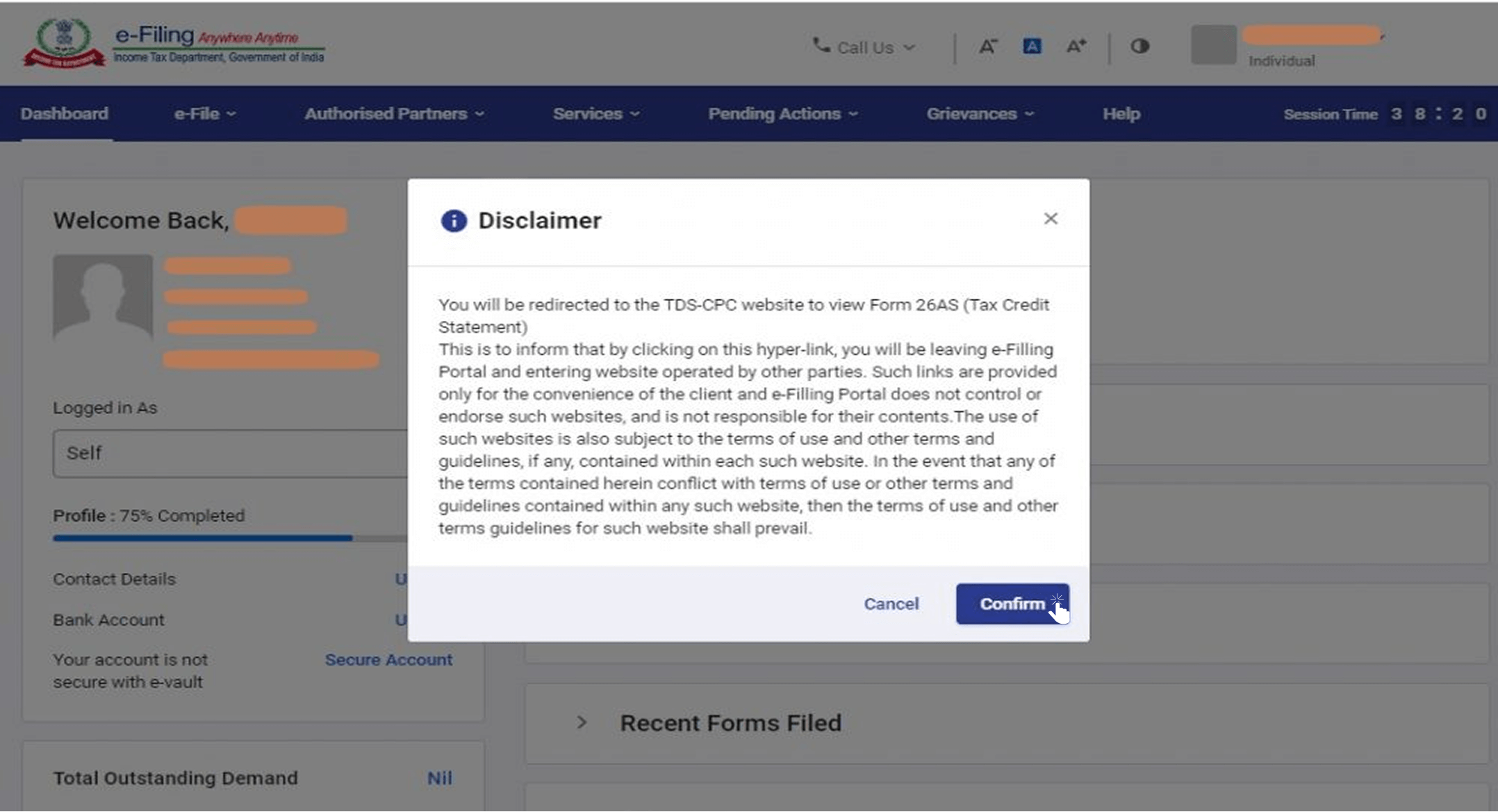

STEP 5 - A disclaimer will now appear. Click on Confirm so that you are redirected to the TRACES website (don't worry, this is necessary and completely safe since it is a government website).

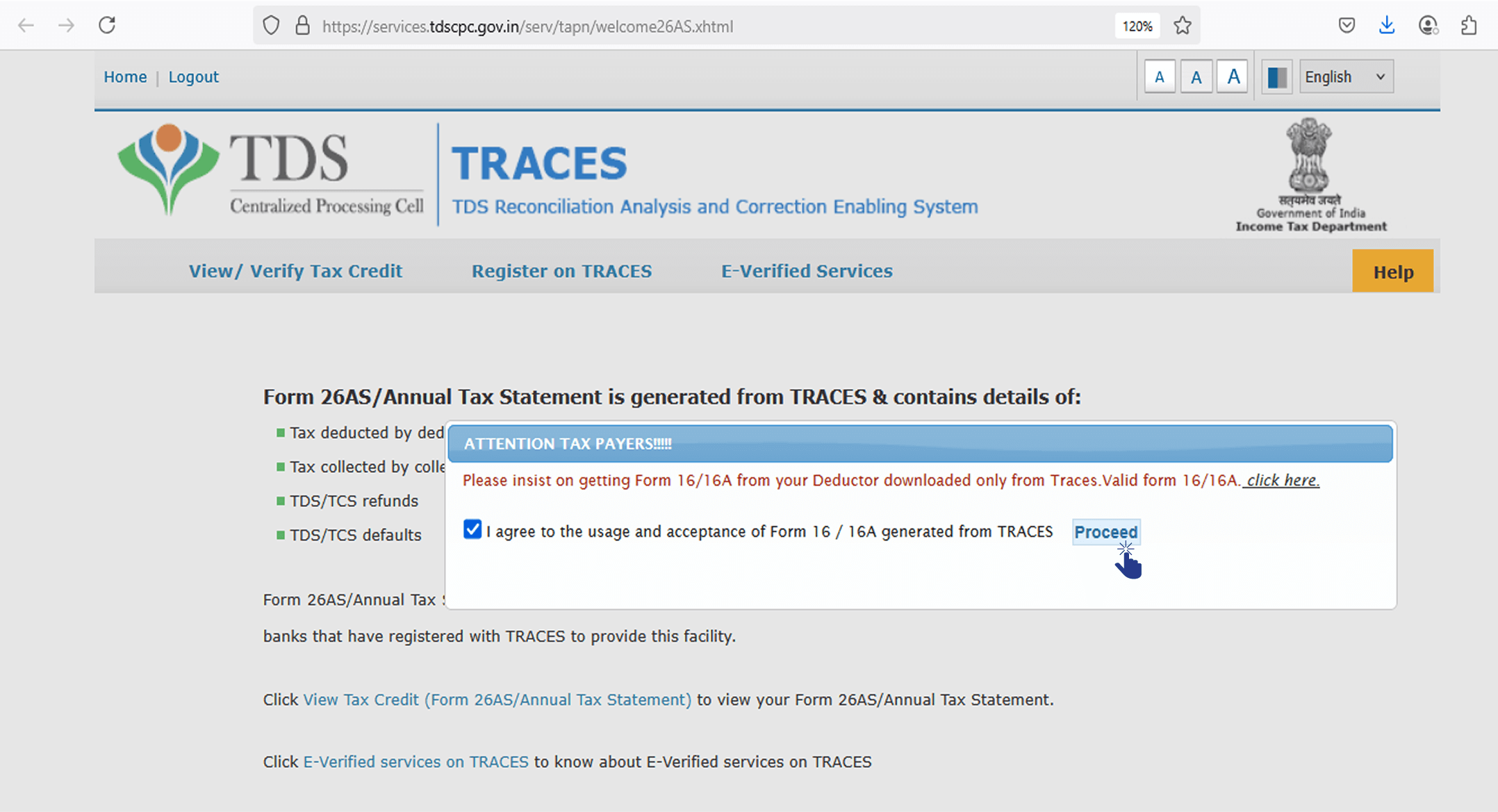

STEP 6 - You are now on the TRACES (TDS-CPC) website. Select the box on the screen and click on 'Proceed'.

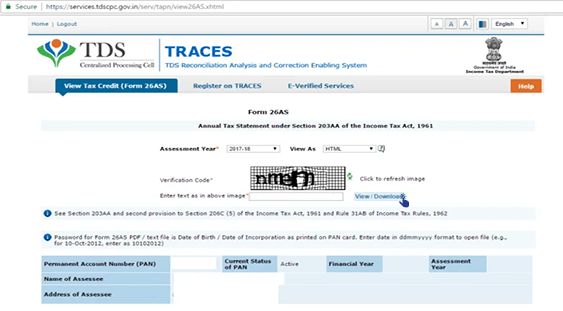

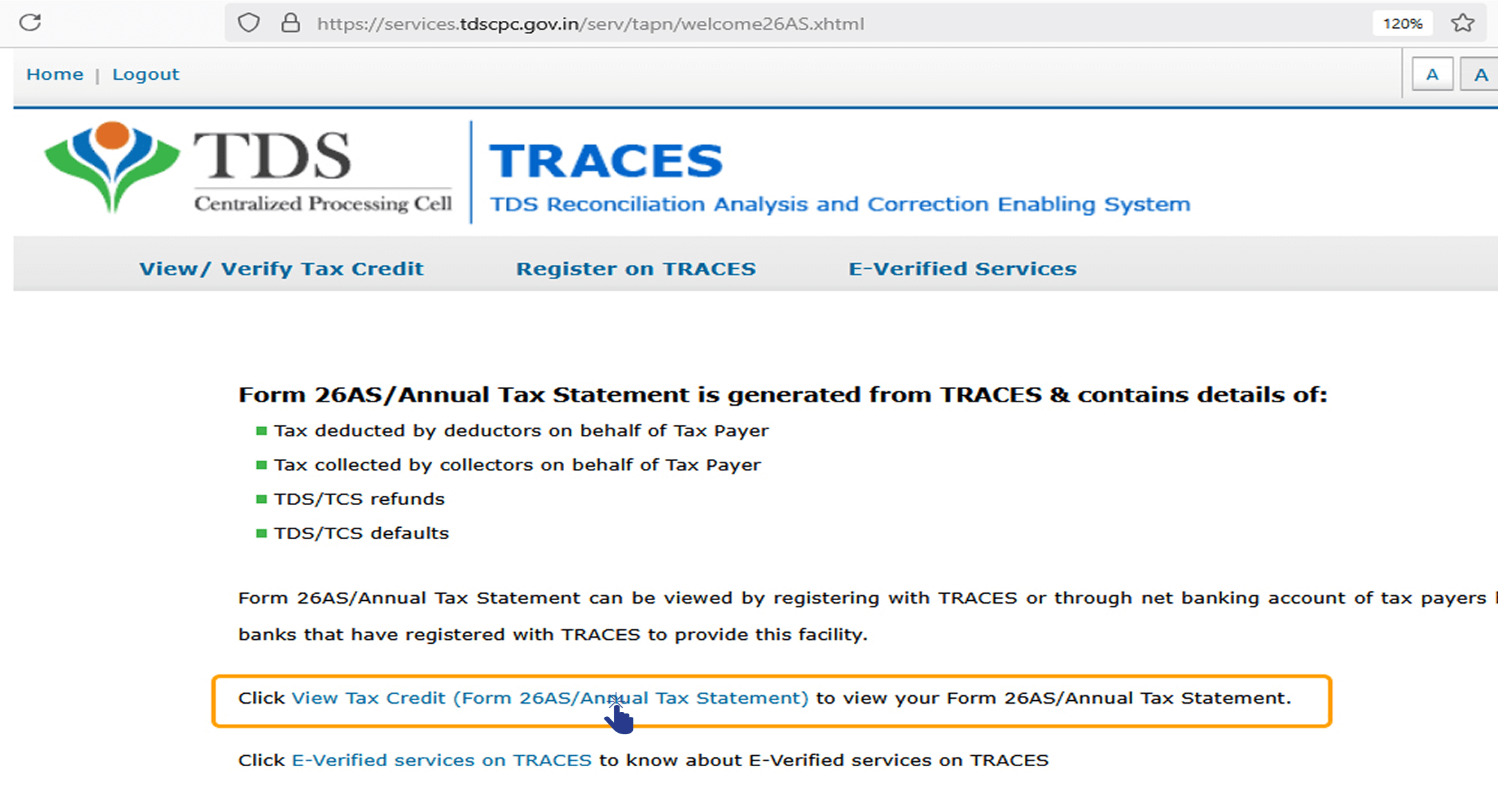

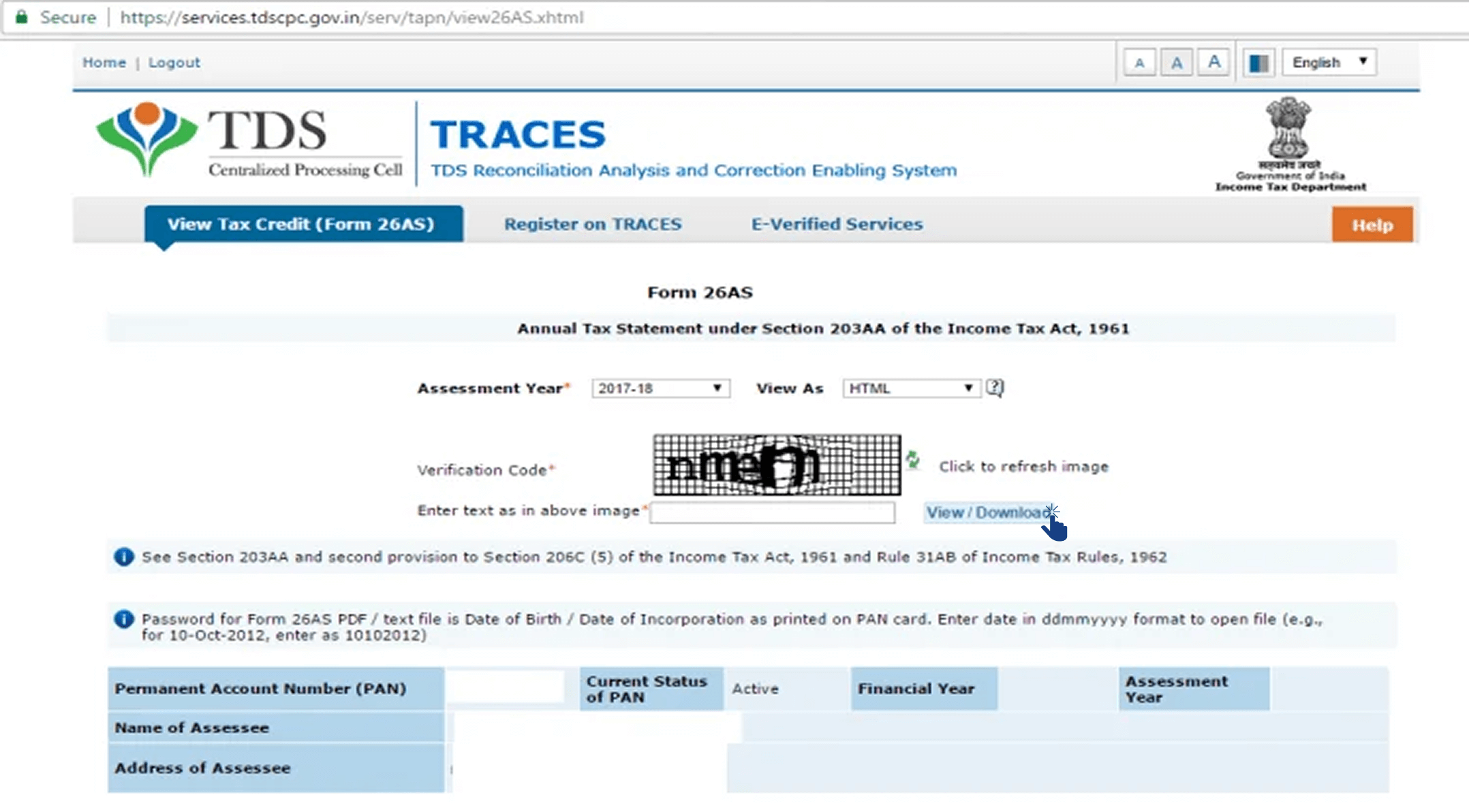

STEP 7 - Click on the link at the bottom of the page – Click 'View Tax Credit (Form 26AS)' to view your Form 26AS.

STEP 8 - Choose the Assessment Year and the format you want to see Form 26AS. If you want to see it online, leave the format as HTML. You can also choose to download it as a PDF. After you have made your choice, enter the 'Verification Code' and click on the 'View/Download' button.

STEP 9 - View and Share - After the download, you can view Form 26AS and share it with us.